You’d be hard-pressed to find something today in the accounting world that can’t be done online. Long gone are the days of a massive carrier bag of receipts for accountants to manually deal with. And for good reason. It’s much easier to make mistakes this way, it’s more labour intensive and it’s just not necessary. Technological intervention tries to protect against mistakes which will reduce fines for people who are self-employed. As such, it would be prudent to look at the Making Tax Digital timeline to make sure that you’re on board!

However, since the beginning of 2022, accountants and people who are self-employed have been raising concerns about the UK’s new digital tax system which is due to be rolled out to nearly 5 million people in 2024. Why? Well, because only 9 people are involved in the pilot of the software.

In March 2020, the UK government published a report called “Making Tax Digital: An Evaluation of the VAT Service and Update on the Income Tax Service.” According to this report:

“MTD is a key part of the government’s ambition for HMRC to become one of the most digitally advanced tax authorities in the world.”

It’s easy to understand why the government wants to make tax digital. There is a huge tax gap every year due to human error. In fact, the Exchequer estimates that for 2017-2018, these errors cost the government £9.9bn in lost revenue! MTD, then, is a way of minimising error, maximising tax payments and reducing the risk of fines for businesses.

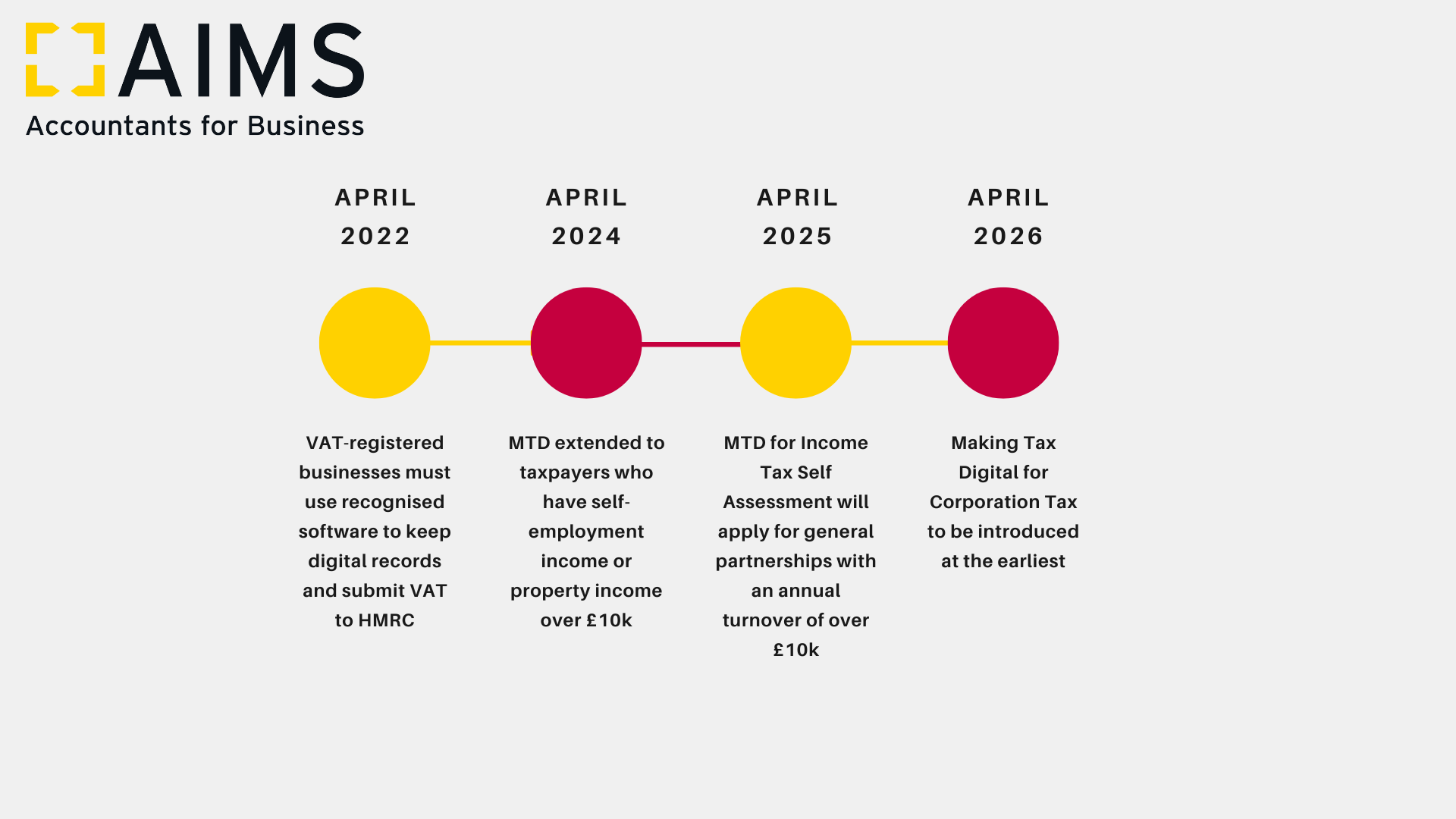

Currently, all VAT registered businesses must by law keep records digitally. They must also file tax returns using software that HMRC has the ability to communicate with. By 2024, this will be extended to taxpayers who have self-employment income or property income over £10k. Here’s a quick overview of the Government’s plans for next few years:

Emma Rawson, technical officer at the Association of Taxation Technicians (AAT), said:

“There was a lack of awareness about the new system. Many self-employed people I’ve spoken to had not heard about the change and were quite horrified to learn they’d have to buy software in a couple of years to do their taxes.”

With nearly 5 million people being required to take up MTD by before April 2024, it is important guidance exists.

Realistically, there will be no major changes in record keeping for many people earning between £10k and £85k because they are already MTD compliant. If you don’t already, though, you must keep digital records of your earnings and expenses under the new plans. These will have to be filed to HMRC every quarter, using third-party software, rather than submit an annual tax return.

Users of MTD will have to choose from a government approved list of software providers. Some offer a free service but tax specialists have warned that these will only be suitable for those with the most basic tax affairs. Specialists expect that many people will have to pay. As such, if you’re self-employed, it’s probably worth trying to make everything digital now!

It is worth noting that most of the government approved software providers will charge a fee, but many of them will offer free trials. Sage, for example, who will be on the government’s list, are doing this at the moment:

With Sage, this is software for VAT, not income tax. Sage have the pilot for self-employed income but not yet for property income. You can also check out the sage website, and other providers’ websites for full MTD guidance. Sage have also released this very simple-to-use tool that will let you know if MTD will affect you. What’s more, the time and money that you’ll save as a business by using software for your tax returns, will more than pay for the software. You’re likely to save a day per week of administration!

All AIMS Accountants are given lots of advice on how to be MTD compliant. This is important because if you become an AIMS Accountant, you’ll also need to pass this advice on to your clients. We do not insist that you use certain software, you can make that decision. However, we have negotiated offers with MTD providers like Sage to make sure that you get discounts!

While this is a commercial decision from the UK government, it will also benefit the self-employed financially. If you make mistakes with your tax returns., you can subject to hefty HMRC fines. New digital means of VAT Returns, Income Tax Returns and Corporation Tax Returns will minimise the chances of this happening. You’ll have more time to spend on your business, making more money.

For accountants who want to work for themselves, you’ll be able to process lots of extra returns for more clients, which increases your earnings potential! As the 21st century envelopes the accounting world, the only thing to do is get on board and make more money! You can find out how to become an AIMS Accountant by clicking here!