UK self-employment since the year 2000 is down. But let’s face it, the economic climate at the minute is cradling a pretty ominous atmosphere. Just 6 weeks ago, John Lewis Partnership Chair, Dame Sharon White, claimed that the exodus of over 50s from the workforce was fuelling inflation. Today, there’s talk of mass unretirement because of the cost-of-living crisis. Is there any wonder that people are scared when stories about a different turmoil are being pushed every week?

Good news stories have always been more difficult to find. Most online news outlets like the BBC now have a dedicated ‘Uplifting Stories’ section because, presumably, every other section is full of doom and gloom.

Do you know what’s even harder to find that good news stories? Good news stories about self-employment. As such, we wanted to look at trends around self-employment to see if we can inspire people to take the plunge!

In 1918, about 100 years before the COVID-19 Pandemic, we had the Influenza Pandemic which is often referred to as Spanish Flu. These pandemics were over 100 years apart, so can be considered rare occurrences.

Yes, COVID-19 has had a significant impact on the ways that we work and on the economy, but it is highly unlikely that anything like this will happen again while anyone alive at the time of writing is still alive. This is why the numbers that you’re about to see should be taken in context.

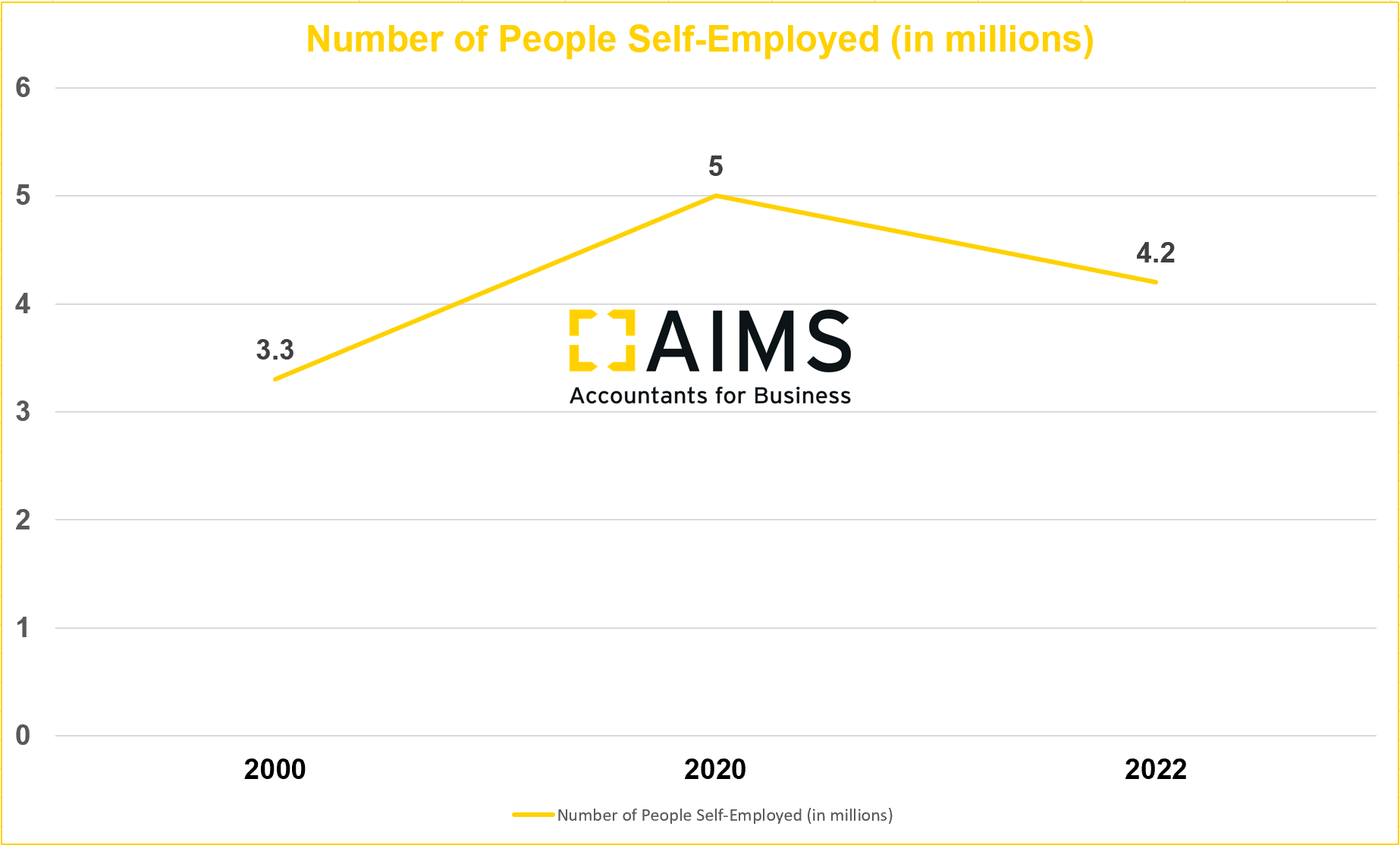

800,000 people went back into employment during the COVID-19 pandemic. This is understandable because a lot of businesses had to cease trading for a while. People didn’t have a choice. However, there are today nearly a million more people who are self-employed than we saw in the year 2000. Also, since the end of 2021, over 100,000 more people have registered as self-employed. COVID-19, then, hasn’t exactly bucked this upward trend. Already these numbers seem to be recovering as we enter a post-COVID world.

To look at where we could be heading in the next few years, it’s worth looking back at pre-COVID data. After all, if COVID was an anomaly, it shouldn’t upset the trends completely!

In December 2019, a few months before the first lockdown, there were 600,000 self-employed mothers. 61.4% of these were able to work part time, compared to 51.8% of employed mothers. Before COVID, then, for mothers who had dependent children, self-employment granted them greater flexibility than their employed counterparts. If you’re a new mother and desire flexibility, self-employment is something that can give you this.

What about age?

In December 2019, the highest percentage of self-employed people were between 45 and 54. They made up 26.5% of self-employed people, compared with 22.7% of employed people. Moreover, people who were 65 years and over made up only 2.7% of the employed workforce, compared to nearly 10% of the self-employed workforce. Self-employed people, then, were older on average, which suggests that self-employment is a great option for people who are in the final 20 years of their careers before retirement. Instead of spending your final years in employment for someone else, choosing your own hours and winding down slowly, with less corporate pressure, could be a great option.

We have to acknowledge some difficulties and downsides, of course. When there’s a global disaster like COVID-19, it’s easy to understand why the self-employed get worried. For starters, they don’t qualify for sick pay or maternity leave. If you had to take time off sick or because you were pregnant during the COVID-19 pandemic, you weren’t earning money. The Government did introduce the Self Employment Income Support Scheme (SEISS) but this only covered 80% of your average monthly trading profits up to a maximum of £7,500 in total.

However, now that there’s no longer a need for the SEISS, people are still choosing self-employment. But why?

Well, much has been said recently about employed people and their wages not rising with the rate of inflation. In June 2022, the real value of workers’ wages fell by 3%, even though they were increased in many sectors. Employment, then, isn’t cutting the mustard when it comes to raising your standard of living.

On the other hand, if you’re self-employed and there’s a demand for your services, you are in charge of your prices and fees and you have much more control over how you alter these in line with inflation. Flexibility isn’t just about being able to take a day off here and there for childcare, it’s about being able to make changes in your business of real value that will impact your pocket.

It would be wrong to suggest that there aren’t challenges in working for yourself. Anything worth having is usually challenging but the rewards are that much sweeter. Now that we are entering a post-COVID world with rapidly increasing inflation, being bold and starting your own business will give you flexibility of real value.

To find out how AIMS can help you achieve this, call James on 020 7616 6622 or message us here.